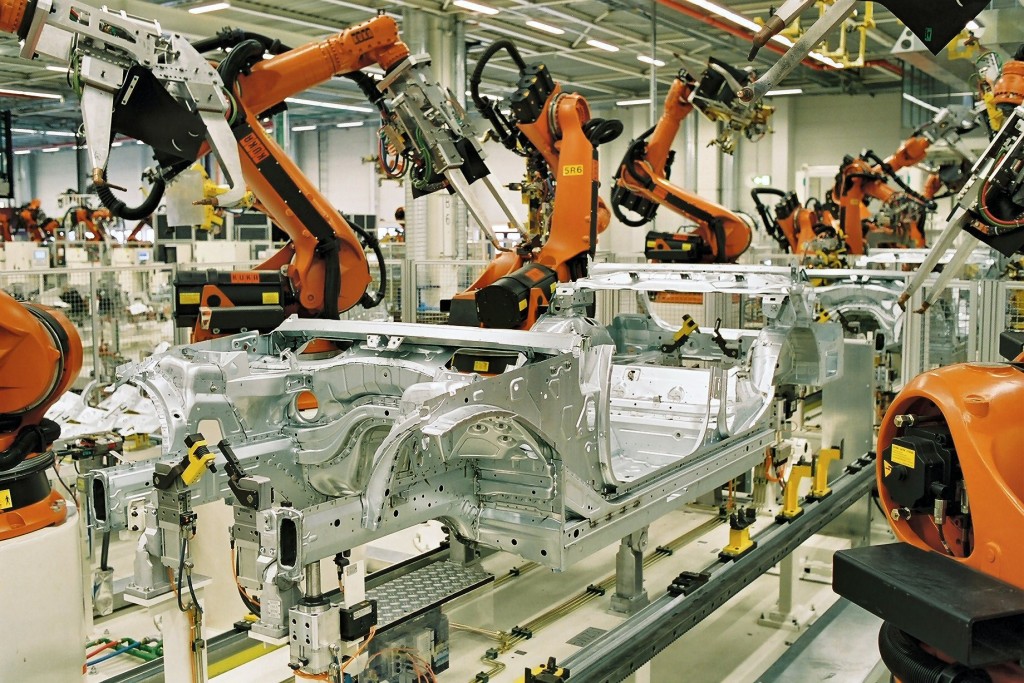

South Carolina has been highly successful attracting large, branch manufacturing operations to the state that provide high-paying manufacturing jobs. Well done. But are there other areas that both policy makers and existing manufacturing companies should focus on with similar vigor?

South Carolina has been highly successful attracting large, branch manufacturing operations to the state that provide high-paying manufacturing jobs. Well done. But are there other areas that both policy makers and existing manufacturing companies should focus on with similar vigor?

In a recent article (1), Jason Zacher, Vice President of Business Advocacy for the Greenville Chamber detailed the Upstate Chamber Coalition’s 2016 agenda that consists of five key areas. One of these is to expand and grow business by promoting initiatives to support small entrepreneurial firms, encouraging innovation, attracting companies who want to locate in the state, and attracting business headquarters. Other business advocacy groups around the state express similar goals. But what does that really mean?

There are a myriad of government policy decisions that can have a positive, or negative impact on the manufacturing sector. While providing incentives for companies to locate manufacturing operations in the state is one of those that remains important, attracting manufacturing corporate headquarters where R&D and product development decisions are made should become a focus. Consider the following. Georgia is the home to twenty Fortune 500 corporate headquarters. North Carolina has fourteen. South Caroline? One.

This is a better long term strategy to grow high paying jobs. First, a company with a corporate presence, including R&D, product development and marketing in addition to manufacturing, will hire engineers and other technical and managerial staff. These jobs are typically higher paying than manufacturing jobs. Second, with a corporate presence, as the firm grows and adds additional manufacturing capacity, there is a much better chance of retaining those operations in the state, expanding manufacturing jobs. And importantly, reducing the need for incentives to re-locate manufacturing operations to South Carolina from outside the state.

John Warner, CEO of Concepts to Companies, who partners with researchers to start companies, recently highlighted the fact that based on data from the US Bureau of Economic Analysis, South Carolina’s GDP per capita has fallen from 13th to the 3rd lowest of any state over the last fifteen years. That is not a positive trend. Could it be that the focus on branch manufacturing, while providing big headlines, is not the best long-term strategy for economic development and growth of high paying jobs?

Having corporate headquarters with R&D operations in the state provides another significant benefit: it helps startups. Creating an environment where startups can thrive and mature into larger organizations is equally as important as investing millions of taxpayer dollars to attract branch manufacturing. While the time horizon is longer, the payoff is more significant.

Having corporate headquarters with R&D operations in the state provides another significant benefit: it helps startups. Creating an environment where startups can thrive and mature into larger organizations is equally as important as investing millions of taxpayer dollars to attract branch manufacturing. While the time horizon is longer, the payoff is more significant.

Startups require access to venture capital. A recent article by John Jeter in the Greenville Business Magazine (2) highlighted the problems in the state for startups to gain access to this funding. To put the issue in perspective, the article cited data from a PricewaterhouseCoopers/National Venture Capital Association report. In 2015, Georgia had 60 deals of about $262.3M, North Carolina had 54 deals in 2014 worth $181.1M. South Carolina had 5 deals in 2015 totaling $39.4M.

How can the state attract more venture capital funding, thereby supporting and growing startups? Having a strong corporate headquarter presence is one aspect of the equation. As Jeter points out in his article: “Simply put, big money follows a strong R&D infrastructure with significant talent and technology.”

What about existing manufacturing companies? Needless to say, while the CEO, owner and president of every manufacturing company wants to see policy makers do more to support them, they cannot rely on government to grow their business. There are many ways to grow revenue: organic market growth, geographic expansion and acquisitions for instance. While those are important, a fourth provides a better strategy for growing not just revenue, but earnings as well. That is through innovation.

What about existing manufacturing companies? Needless to say, while the CEO, owner and president of every manufacturing company wants to see policy makers do more to support them, they cannot rely on government to grow their business. There are many ways to grow revenue: organic market growth, geographic expansion and acquisitions for instance. While those are important, a fourth provides a better strategy for growing not just revenue, but earnings as well. That is through innovation.

The problem is that much of the focus in manufacturing companies today is on efficiency and implementing lean manufacturing as a way to grow earnings by reducing the cost structure. In a recent article in South Carolina Manufacturing (3), I opined that the lean methodologies are in fact being abused. It is a misguided strategy to rely solely on lean to provide a silver bullet for long term earnings growth. You can “lean” yourself right out of business.

While focusing on efficiency is important, a better long term, more sustainable strategy to grow both revenue and earnings is by innovating. But what does that really mean? Innovation may be perhaps the most overused word in the business lexicon today and there are varying opinions on its meaning. But no matter how defined, it entails finding ways to create new products and services that can grow average selling price and margins or generate entirely new revenue streams.

But what are the key aspects of becoming more “innovative”? Consider the following:

Management Model and Culture

First and foremost is the management model and culture. The “traditional” management model is being disrupted (4). It was built for the industrial age and is no longer relevant in today’s digital, interconnected world. The management model and the culture should also be viewed as a source of sustainable competitive advantage. Unlike business models and product innovations, the management model and the supporting culture cannot be easily duplicated by competitors.

Senior Manager Engagement

Innovation in both business models and products is a key business process. It encompasses every functional group in the business, and is ultimately the responsibility of the senior leader in the business. It requires a high level of engagement. If “innovation” is viewed as R&D’s responsibility, the business will ultimately suffer.

Effectiveness, Not Efficiency

The traditional management model emphasizes efficiency. That’s what lean manufacturing is all about. While incremental product enhancements can be thought of as more “efficient” projects, radical innovation that generates new sources of revenue and earnings is more risky. This type of innovation is messy, and often “inefficient”. While many senior leaders lament the need to be more “innovative”, the reality is they are not comfortable with the uncertainty. Innovation, therefore, should be viewed more in terms of effectiveness, not efficiency.

Over-reliance on Existing Knowledge

Every business was at one time a startup, creating new knowledge. Maybe it was a new business model, or applying a cutting-edge technology to meet a latent customer need. At some point, to monetize that knowledge, it must become an algorithm. In a manufacturing company, the algorithm can be the drawings and manufacturing work procedures to fabricate and assemble the product.

Many existing businesses, however, become overly reliant on existing knowledge. In today’s world, knowledge has become a commodity. It moves seamlessly and quickly through the global economy. An imperative for every company, therefore, is to create new knowledge to maintain competitive advantage and grow revenue and earnings. That means allocating resources and investing in more risky projects. Not easy for a CEO in a public company rewarded on quarterly results.

Innovation Processes

Finally, institutionalizing innovation via effective processes is crucial. The many processes and sub-processes focus on work flow, information flow, or decision flow. They require close collaboration between management, R&D, Manufacturing and Marketing. Many surveys and statistics prove that companies with robust processes are more successful at innovation. These include the front-end processes where customer needs are understood, ideas are captured, decisions on what should be developed and products fully defined. Once a project starts, then execution is center stage. The use of phased development processes, understanding project risk and choosing the right project management tools become paramount.

In summary, South Carolina has been successful at attracting many large multi-national manufacturing operations to the state. But we can do better. We must attract corporate headquarters that make decisions on new products, and hire higher-paying technical staff in engineering, marketing and managerial positions. These companies in turn are more likely to bring additional manufacturing jobs to the state as they grow. A more advanced corporate R&D infrastructure will attract higher levels of venture capital, enhancing the ability of startups to acquire funding and grow. And finally, existing manufacturing companies must embrace innovation as a way to grow revenue and earnings. Policy makers and business advocacy groups can assist industry’s effort to become more innovative in many ways including supporting education and providing innovation training resources.

Notes:

- Zacher, Jason. January, 2016. Moving the Upstate Forward in 2016. Greenville Business Magazine. Pages 12-13.

- Jeter, John. January, 2016. Adventures in Venture Capital. Greenville Business Magazine. Pages 28-29.

- “Abusing Lean Methodologies” (https://www.southcarolinamanufacturing.com/abusing-lean-methodologies/) SouthCarolinaMfg.com. Jeff Groh. Nov. 30, 2015.

- “Disrupting the Management Model” (https://www.southcarolinamanufacturing.com/disrupting-the-management-model/) SouthCarolinaMfg.com. Jeff Groh. Jan. 6, 2016.

Jeff Groh is President of New Product Visions (newproductvisions.com) located in Flat Rock, NC. New Product Visions helps companies improve their innovation management practices. We focus on processes, organization, management engagement and culture. Services include consulting, Innovation Coach™ Workshops (newproductvisions.com/workshops) and software enablers. Mr. Groh spent 30+ years in industry in a variety of management roles in sales, manufacturing and new product development prior to starting New Product Visions. He is particular passionate about the role of senior management and the culture that supports innovation success. For additional information or a no-cost on-line assessment of your company’s innovation management practices, email Jeff at jgroh@newproductvisions.com or by phone at (302)-367-3160. Available for select speaking engagements.

Be the first to comment on "Corporate HQ’s with R&D Are Critical for High Wage Jobs Needed to Raise State’s Near Last Place GDP Per Capita"